Ecommerce fraud is a serious issue. According to Statista, online retailers across the world lost a total of $41 billion to payment fraud in 2022.

While you may think banks are on the hook for reimbursing fraudulent purchases, that’s not always the case.

When customers order online, there’s increased risk because they’re not physically handing you a credit card to pay. As a result, online sellers are often responsible for paying back any credit card charges that need to be reversed.

So, how can you prevent fraud in your Magento store?

Understanding the types of fraud and finding the best strategies to detect and prevent attacks are key to protecting the financial health of your ecommerce business.

Keep reading to learn:

- What is ecommerce fraud?

- Types of ecommerce fraud

- How to detect fraudulent ecommerce orders

- How to protect your Magento store from ecommerce fraud

- Final thoughts: protecting your Magento store from ecommerce fraud

What is ecommerce fraud?

Ecommerce fraud refers to financial fraud that specifically targets ecommerce platforms. Also known as payment fraud, it can lead to financial loss for the online store, its customers, or both parties.

Let’s take a look at the different types of ecommerce fraud to get a better understanding of how it can affect your business.

Types of ecommerce fraud

- Credit card fraud

- Chargeback fraud

- Refund fraud

- Account takeover (ATO) fraud

1. Credit card fraud

Credit card fraud happens when the scammer uses stolen credit card information to make a purchase through your ecommerce store. It results in a financial loss for the customer.

That said, this type of fraud can still impact ecommerce stores. For example, the person who had their credit card information stolen could notice the purchase and file a fraud claim. In that case, it may fall on you (not the bank) to reimburse them for the purchase.

Ecommerce sellers may be liable for reimbursements because, unlike at physical stores, the credit card is not physically present at the time of the purchase.

Your online store takes the added risk of accepting card-not-present (CNP) transactions. As such, you can be held liable.

2. Chargeback fraud

Chargeback fraud, also known as friendly fraud, happens when a customer or attacker buys something from your online store and then claims that the purchase was fraudulent.

It’s similar to credit card fraud, except the customer’s credit card information might not be stolen. Instead, the customer may make the order, receive their item, and then claim fraud to get their money back.

One thing to understand here is that chargebacks are different from refunds. When you issue a refund, the customer goes through you to get their money back. So, they have to get approval from your store.

In a chargeback, the customer bypasses you and gets money back from the bank that issued their card. The bank then turns around and charges you for that amount plus chargeback fees.

Beyond that, you’ve spent money on marketing, shipping, and fulfillment for that order.

According to a Signifyd study, ecommerce stores lose an average of $206.80 for every $100 in fraudulent orders. That’s more than double the actual transaction amount.

3. Refund fraud

In refund fraud, the scammer uses stolen credit card information to make a purchase and then requests reimbursement from the online seller.

Often, the person scamming the company will send you more money than the transaction was worth. Then, they’ll ask you to refund the excess through a different payment method to avoid having to return the item.

If the person whose card was stolen notices the fraudulent purchase, they may alert their bank. This results in a chargeback of the transaction amount.

4. Account takeover (ATO) fraud

In a total account takeover scam, the fraudster gains unauthorized access to one or several customer accounts. They then use saved payment methods to make purchases without the owner’s consent.

This attack creates a risk of chargebacks that you may have to pay. Beyond that, it can also damage your brand’s reputation if customers blame the loss on your lack of security or account protection.

How to detect fraudulent ecommerce orders

The first step in protecting your Magento store against ecommerce fraud is learning to identify it.

Here’s a list of red flags that may signal fraudulent orders during an automated or manual review:

- The placement of repeated small orders.

- Orders that are significantly larger than average.

- Customers paying more for expedited shipping.

- Customers using multiple shipping addresses.

- Different billing and shipping addresses.

- Billing and shipping addresses that don’t match the IP address of the buyer.

- Customers using multiple credit cards when shopping from the same IP address.

- Customers shipping multiple orders from different credit cards to the same address.

It’s important to note that there’s such a thing as being overly conservative in your fraud detection. Some of these red flags can be normal behavior.

For instance, a customer ordering a gift may use a shipping address that’s different from their billing address. You may also see customers ship to multiple addresses during the holidays. This makes it difficult to tell real and fraudulent purchases apart.

In fact, the Signifyd study estimates that ecommerce retailers rejected $24 billion in real purchases during the 2022 holiday season because they incorrectly labeled the orders as fraudulent.

These types of false positives create financial loss and damage the customer experience.

So, how do you walk the line between protecting your business from fraud and allowing real purchases?

In this case, automation becomes a valuable asset in helping you detect and prevent ecommerce fraud. Finding the right plugins or extensions for your Magento store can help you detect and identify fraudulent orders in real time.

How to protect your Magento store from ecommerce fraud

Several fraud protection platforms work well with Magento. Here are the tools we recommend.

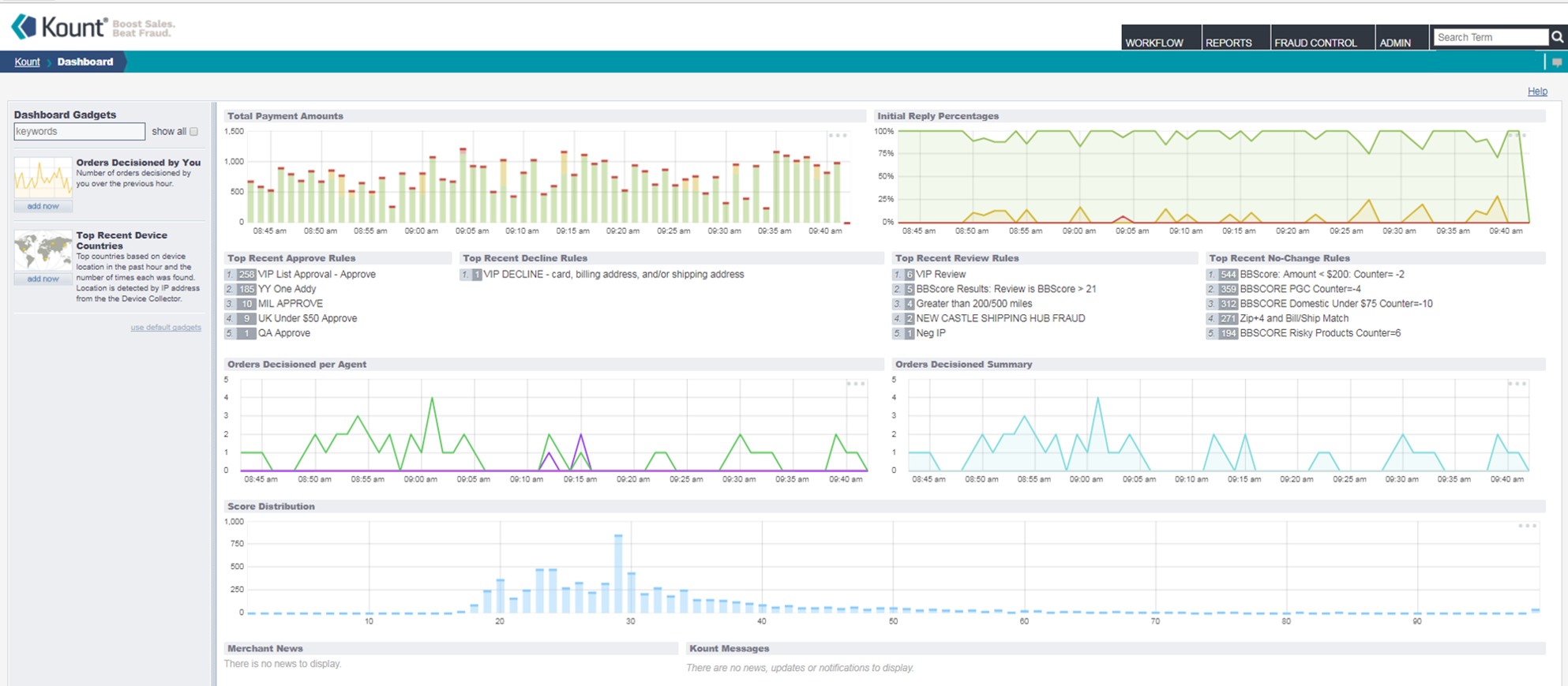

Kount Magento fraud prevention

Kount is an industry-leading fraud prevention tool for ecommerce platforms, including Magento 2.4. It uses machine learning to analyze your orders and identify potential threats. You can configure Kount to decline possible fraudulent orders automatically based on your preferred risk level or custom blacklist settings.

Kount reduces false positives by up to 70 percent and chargebacks by up to 99 percent. It can also monitor and rate customer accounts and reduce ATO attacks that hurt your brand’s reputation.

Price: Custom.

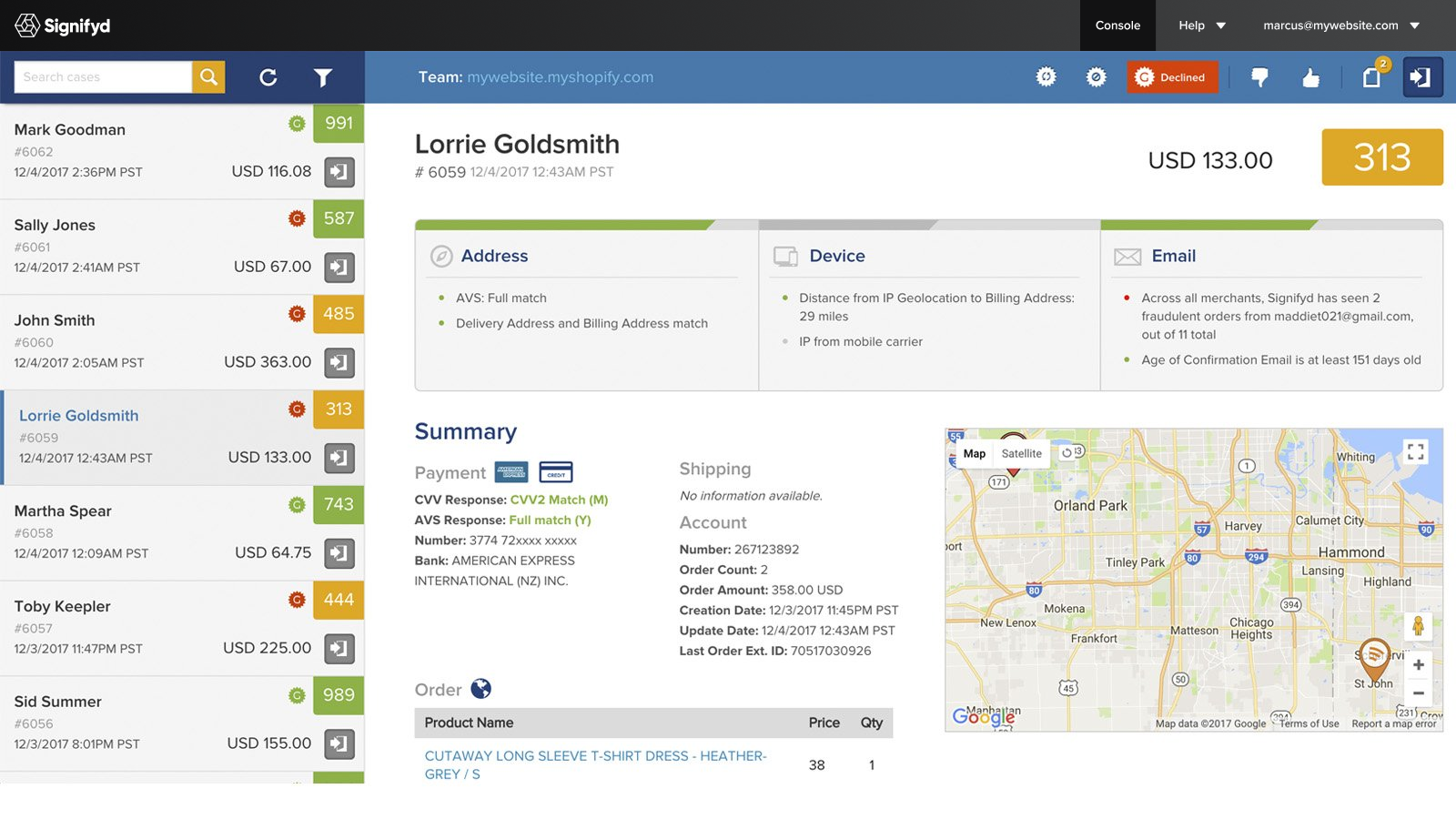

Signifyd Magento chargeback protection

Signifyd has a Magento integration that provides Magento 2 users with an automated fraud prevention solution. The platform uses machine learning algorithms to review every transaction in real time and tell you whether to accept it.

If the platform detects a fraudulent order trying to check out, it will recommend that you reject it.

One benefit of Signifyd is that it offers 100 percent chargeback protection. In other words, if Signifyd fails to detect a fraudulent order, it will pay for the chargeback, so you’re not liable.

Price: Custom.

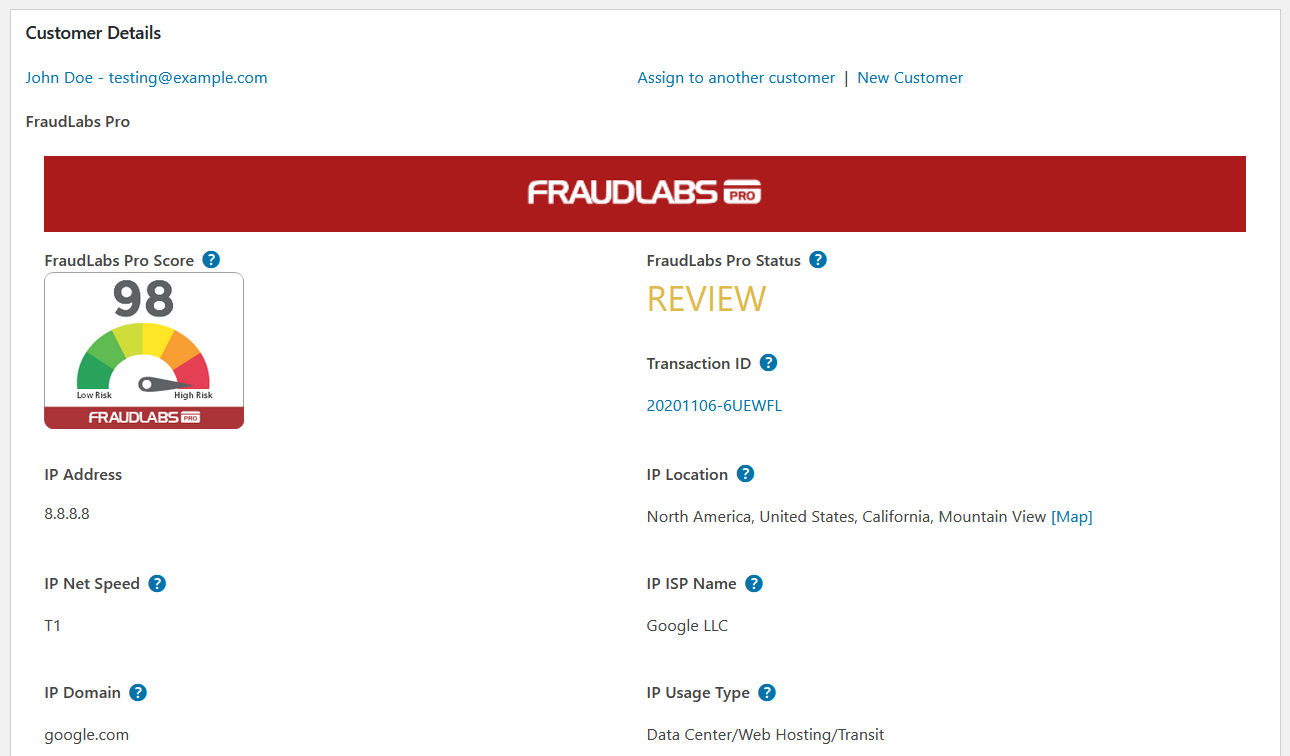

Fraudlabs Pro fraud prevention

FraudLabs offers a free fraud prevention extension that integrates with Magento 2. The extension is easy to set up and runs every order through a wide variety of checks using a customizable set of rules.

FraudLabs validates each order’s email address, IP geolocation, billing and shipping addresses, and other factors. It approves, rejects, or marks the order as “pending review” based on the fraud score, reducing the amount of manual order validation required.

FraudLabs is free for up to 500 transactions per month, making it ideal for smaller ecommerce stores that want to dip a toe into automatic Magento fraud prevention.

Price: Free (with reduced features). Premium plans start at $29.95/month.

Additional steps you can take to reduce ecommerce fraud

In addition to using a fraud prevention tool, you can take the following steps to improve the security of your Magento store and make it harder for fraudsters to complete their orders:

- Set purchase limits.

- Remove inactive plugins.

- Get a Secure Socket Layer (SSL) certificate and keep it current.

- Use a Payment Card Industry (PCI)-compliant hosting provider, like Nexcess.

- Back up your online store frequently.

- Regularly scan your website for malicious software or code.

- Keep your shopping cart software and related plugins up to date.

- Use strong passwords and two-factor authentication (2FA) to keep your website secure.

Final thoughts: Top tools you can use for Magento fraud protection

When you’re processing ecommerce orders, there’s a bigger risk of fraud because your customers aren’t physically running their credit cards. This means you can end up on the hook for reimbursing fraudulent purchases that go through your store.

That said, if you end up overprotecting your store, you risk declining real orders and creating a negative customer experience.

Adding automated fraud detection and protection to your Magento store can help with fraud detection optimization. That way, you can recognize more real threats without sacrificing legitimate customer orders.

For even more protection for your online store, check out the PCI-compliant hosting plans from Nexcess. Our fully managed Magento hosting plans offer secure payments, proactive security features, free SSL certificates, and daily backups.

Browse our managed Magento plans to get started today.