Choosing an ecommerce payment processing provider for your online business is an art.

On the one hand, you want to give your customers the most convenient payment processing solution to make the checkout process a breeze. On the other, you also have to balance it against other factors like integrations, security, and cost.

In this guide, you’ll learn how to choose the best payment processor for your business needs. You’ll also learn all about ecommerce payment processing, specifically:

- Ecommerce Payment Processing 101

- Elements of Ecommerce Payment Processing

- How Ecommerce Payment Processing Works

- Considerations for Choosing an Ecommerce Payment Processing Platform

- Popular Ecommerce Payment Solutions

- Final Thoughts: The Ultimate Guide to Ecommerce Payment Processing

Ecommerce Payment Processing 101

Ecommerce payment processing is the action of accepting payments from customers through a secure terminal or gateway that conceals sensitive customer information. Customers pay for their online transactions using various payment methods — so your payment processor should be able to support them.

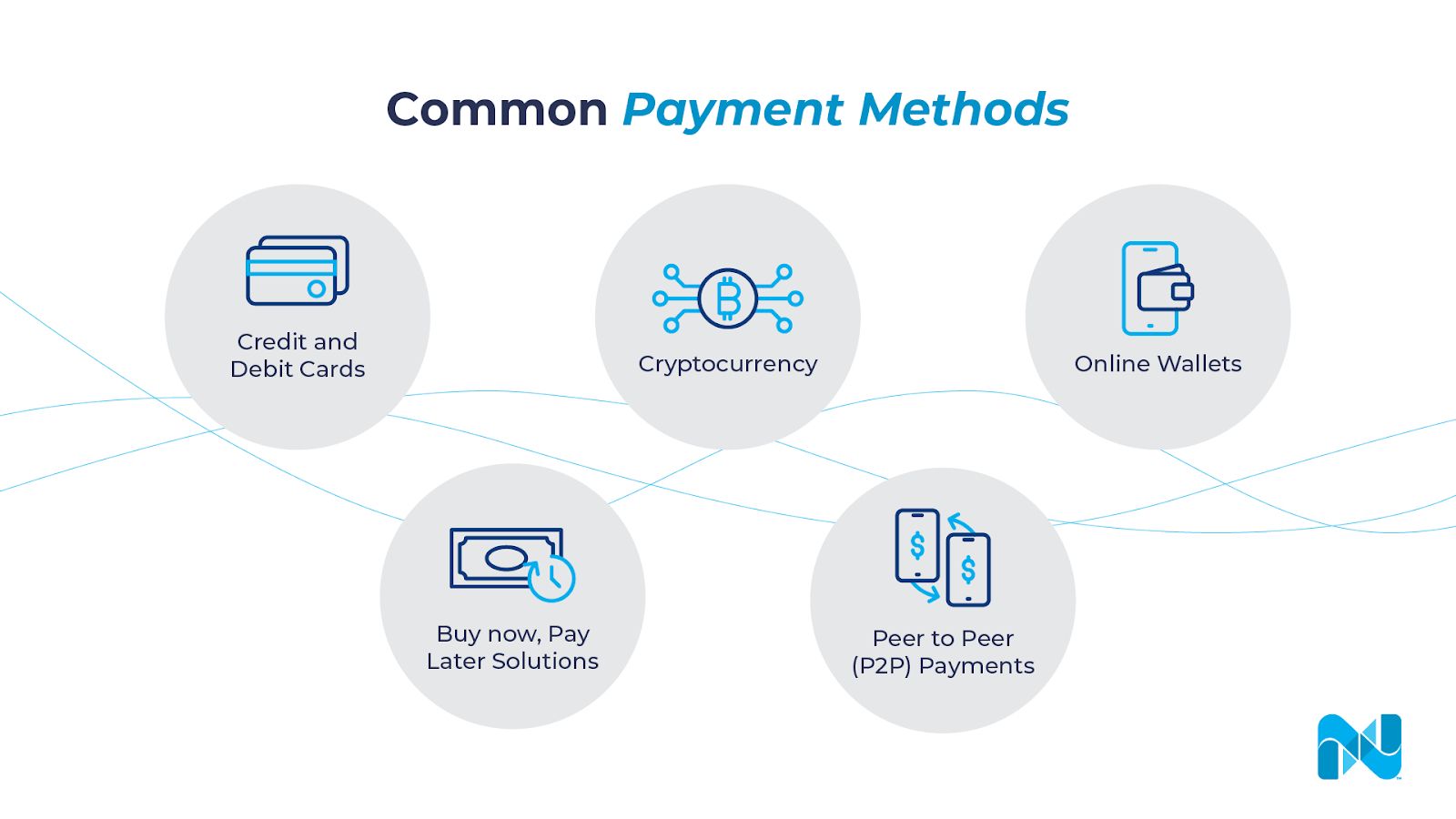

Here are a few common payment methods:

- Credit and debit cards: These are among the most popular and preferred ways to pay for both online shopping and offline transactions. Most payment processors accept major credit cards such as Visa, Mastercard, or American Express.

- Online wallets: Digital wallets like Apple Pay and Amazon Pay store a customer’s payment information, making it easy to pay for mobile or platform-specific purchases. According to Fiserv’s 2021 study on customer payments, more people are using digital wallets for payments. The study shows a growing comfort in the technology, especially in millennial and Gen Z age groups.

- Buy now, pay later (BNPL) solutions: These are short-term loans offered to customers that let them purchase items now and pay for them at a later date, without needing a credit card. Financial startups like Klarna and Affirm popularized this method. In fact, credit card usage declined during the 2021 holiday season, in favor of mobile wallets and BNPL solutions.

- Peer-to-peer (P2P) payments: Popularized by Venmo, P2P refers to electronic money transfers between two bank accounts through a third-party website.

- Cryptocurrency: These are alternative and decentralized digital currencies offered in limited quantities and traded in their own markets. Some brands like Microsoft accept payment in the form of crypto.

Elements of Ecommerce Payment Processing

Before we look at how ecommerce payment processing works, let’s go over its three key players: the payment gateway, payment processor, and merchant account.

- Payment gateway: This is the interface you see on your website’s checkout page that collects customer data and connects it to your payment processor.

There are two types of payment gateways:

- Hosted solutions like PayPal send shoppers off-site to complete payment.

- Self-hosted gateways like Stripe enable users to complete transactions on the ecommerce merchant’s website.

- Payment processor: This is the payment service that acts between the payment gateway and the merchant account. It’s integrated into the ecommerce platform and handles monetary transactions like crediting the customer and transferring the money to your merchant account.

- Merchant account: This is the bank account in which the payment from the processor is deposited after the customer’s payment has been cleared and verified.

How Ecommerce Payment Processing Works

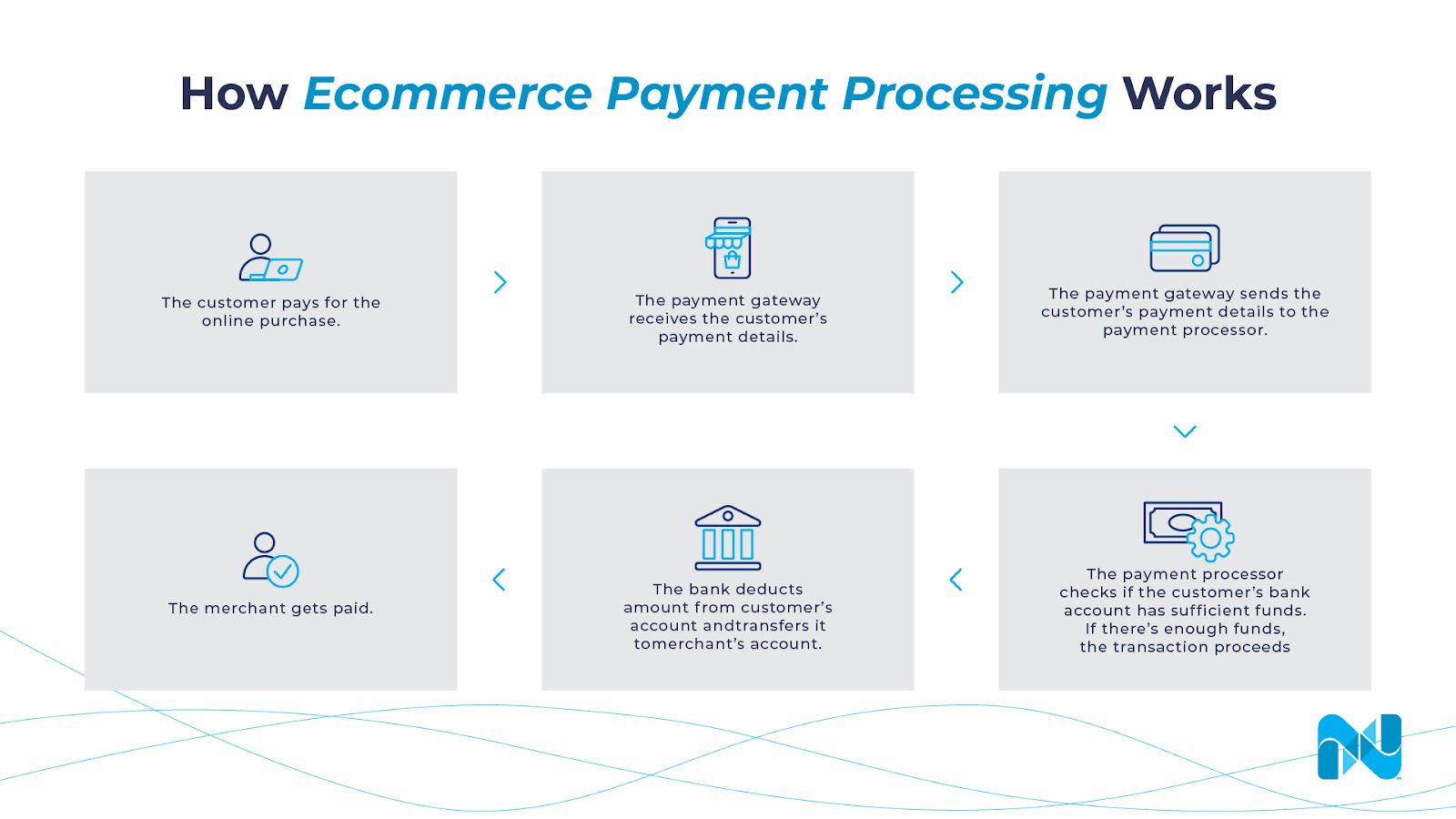

At checkout, a customer enters their debit or credit card information into a secure form on your website or mobile app. The payment gateway sends your customer’s secure payment details to the payment processor.

The payment processor then consults with the credit card’s issuing bank to check whether there are sufficient funds. If there are enough funds, the customer’s financial institution authorizes the transaction. If there aren’t, they decline it.

The payment processor lets the payment gateway know whether the transaction was successful or not. The payment gateway then transmits this information to the ecommerce website, informing the customer.

If the transaction was authorized, the customer receives an order confirmation — usually through a receipt. If not, they’ll be asked to try again.

Even though the customer has received their confirmation receipt, the process doesn’t end there. The funds from the transaction have to appear on the merchant account first.

When a transaction is successful, the payment processor transfers the funds from the customer’s bank account to the merchant’s account.

That can take anywhere between a few hours to days for the money to reflect on the merchant account. But the whole process of payment to order confirmation only takes a few seconds.

Considerations for Choosing an Ecommerce Payment Processing Platform

There are several payment processing platforms available — each catering to different customer needs. Consider these features before choosing a provider:

Security

Security should be a top concern when choosing an ecommerce payment processing platform. After all, you're dealing with customers’ sensitive information.

Your payment method should be compliant with the Payment Card Industry Data Security Standard (PCI-DSS compliant). This ensures point of sale (POS) terminals and ecommerce websites meet a set of standards that protect credit card holders from fraud.

Besides choosing a PCI-compliant processor, you can also contribute to site security by getting an SSL certificate for your ecommerce website to encrypt transactions.

Also, choose ecommerce web hosting like Nexcess, a level 1 PCI-DSS provider that can help your website get set up for PCI compliance.

Accepts Multiple Payment Methods

According to Fiserv's 2021 study on customer payments, shoppers expect stores to accept multiple payment methods.

Offering options puts you at an advantage — especially when dealing with international clients — because some popular payment options aren't available in certain countries. For example, PayPal isn't available in Pakistan.

Your payment processor should also accept credit and debit cards from different countries and process transactions in various currencies.

Multiple payment channels give customers options to choose from when they have a preferred method or if their main payment method doesn’t work.

By giving your customers options, you also prevent cart abandonment. According to the Baymard Institute, not having enough payment options was one reason for abandoned shopping carts.

Integrations

Your payment processor should be able to integrate with your ecommerce platform. It should also work with tools such as your invoicing and accounting software, social media shops, and any other merchant services you use.

Costs and Fees

Other factors to consider when choosing a payment processor are costs and fees. You’ll want to keep these fees low because they eat into your margins.

Some costs and fees associated with ecommerce payment platforms include:

- Set up costs: These are costs associated with setting up the payment processor. For example, Stripe accepts online and POS payments, but if you need a card reader, you have to pay for it.

- Monthly subscription fee: On top of transaction fees, some payment solutions charge a monthly subscription fee to use their service. For example, Square is generally free to use — but if you want advanced features, you need to pay at least $60 per month for them. On the other hand, WooCommerce Payments doesn’t charge a monthly subscription fee to use its service.

- Processor fees: These are what your credit card processor charges for acting as an intermediary between your business and the credit card company. These fees range between 1-5%. Some platforms charge a percentage on top of a small flat fee. For example, WooCommerce Payments charges 2.9% + $0.30 per credit card transaction.

- Transaction fees: These are fees ecommerce platforms charge for their use. Transaction fees vary depending on the platform, type of product, subscription plan, and other factors. For example, Etsy charges 6.5% in transaction fees, which are separate from the payment processor fees.

Popular Ecommerce Payment Solutions

- PayPal.

- Stripe.

- Square.

- Adyen.

- Authorize.net.

1. PayPal

PayPal is one of the most popular payment processors in the world — Statista shares that 83% of U.S. shoppers have used it in the last 12 months.

PayPal is available in over 200 countries worldwide and supports multiple types of payments. It processes online payments via PayPal Checkout and lets you accept payments through virtual terminals, physical POS terminals, and QR codes.

Having a PayPal option on your website can also boost conversion rates. Online stores with a PayPal checkout option reported a 28% increase in conversions.

Advantages:

- Available in over 200 countries.

- Supports multiple types of payment methods.

- Easy to use.

Disadvantages: High transaction fees.

Types of payments accepted: PayPal balance, bank account, Venmo, PayPal Credit, all major debit or credit cards, and rewards balance.

Transaction fees:

- 3.49% + $0.49 for most commercial transactions.

- 2.99% + $0.49 for credit and debit transactions.

2. Stripe

Stripe is a secure online payment processing platform that lets ecommerce stores and subscription sites accept both online and in-person payments. Customers can use credit and debit cards, digital wallets, cryptocurrency, and even BNPL services.

Create your own payment processor using Stripe’s API, which powers a range of global payment methods. It lets you accept a variety of payment methods using a single API.

Advantages:

- Can process recurring payments, which makes it perfect for membership and subscription websites.

- PCI-compliant.

- Transparent pricing.

Disadvantages:

- Limited availability.

- Primarily geared towards online stores (so may be difficult to set up if you also have a physical store).

Types of payments accepted: Major debit and credit cards, bank debits and transfers, BNPL, cryptocurrency, vouchers, and wallets.

Transaction fees:

- 2.9% + $0.30 for online transactions (+1% for international credit cards or transactions where currency conversion is required).

- 2.7% + $0.05 for in-person transactions.

Monthly fees: Free Stripe plan available. Contact Stripe for customized plans.

One-time payment: Hardware costs start at $59, depending on type of terminal.

3. Square

Like Stripe, Square processes digital wallet and debit and credit card payments using its online platform and POS software that turns your mobile phone into a card reader.

Besides advanced features like payroll and inventory management, Square also has a comprehensive suite of products that cater to specific industries like retail, food and beverage, and services.

Advantages:

- Easily integrates with ecommerce shops.

- Free plan is enough for most online stores.

- Industry-specific features.

Disadvantages: Not ideal for large companies due to stability issues.

Types of payments accepted: Credit and debit cards, Apple Pay, Google Pay, Samsung Pay.

Transaction fees:

- 2.6% + $0.10 for in-person credit card payments.

- 2.9% + $0.30 for payments through your ecommerce shop.

Monthly fees: Free Square plan available; Square Plus plan for advanced features starts at $60/month.

One-time payment: Hardware costs start at $149, depending on type of terminal.

4. Adyen

Adyen is a Dutch payment solution that caters to online, POS, and mobile payments. It’s trusted by large brands such as Pinterest, Tiffany & Co., and Tory Burch for its ability to handle large transaction volumes.

Adyen is also secure — its software is built from scratch, and doesn’t rely on third-party data. Adyen supports over 350 payment methods and 150 global currencies and has among the lowest transaction fees in the industry.

Advantages:

- Low transaction fees.

- Can handle large transaction volumes.

- Secure.

Disadvantages:

- Complex payment structure depends on location and payment method.

- Built primarily for online payments. Little support for POS solutions.

- Not the best payment solution for small business owners because it requires merchants to meet a monthly invoice minimum.

Types of payments accepted: Credit and debit cards, Apple Pay, Amazon Pay, Google Pay, Samsung Pay, and BNPL solutions like Klarna, Affirm, AfterPay, and ClearPay.

Transaction fees: Adyen charges a $0.12 processing fee + a local interchange fee that depends on the type of payment. For example, credit card interchange payments are 2% in the U.S. and 0.3-0.4% in Europe.

Check Adyen’s pricing for more information.

5. Authorize.net

Authorize.net is one of the oldest payment gateways available that helps merchants accept credit card and electronic payments on their websites. Because it’s run by Visa, expect nothing less when it comes to security — its advanced fraud protection system detects suspicious transactions and IP addresses.

Advantages:

- Advanced fraud protection.

- 24/7 customer support.

- Transparent pricing.

Disadvantages:

- Outdated website interface.

- Monthly fee.

Types of payments accepted: Credit and debit cards, Apple Pay, PayPal.

Transaction fees: $25 monthly fee and 2.90% + $0.30 per transaction.

Final Thoughts: The Ultimate Guide to Ecommerce Payment Processing

It’s crucial to learn about the different payment systems available and compare them according to price, security, and integrations. Doing so empowers you to choose the right payment processing service provider that suits your ecommerce business’s needs.

By choosing the right payment processor, you can deliver a smooth checkout process that lowers cost, reduces shopping cart abandonment, and improves customer experience.

A good payment processor complements an optimized ecommerce website.

Ecommerce solutions like Nexcess’ Managed WooCommerce hosting has features designed especially for ecommerce shops. Sign up for a plan today.