Business insurance is critical for an online store. Most people in business know this but find it difficult to understand the insurance lingo.

The jargon agents use when buying insurance can overwhelm business owners who haven’t heard a lot of it before. However, it’s important not to let it scare you away because business insurance will help you protect your business assets when things go south.

Insurance agents can help you get a lay of the land, but you shouldn’t rely on them entirely. After all, they work on commission. Instead, educate yourself about insurance before meeting with the insurance agent so you can ask the right questions.

In this guide, we’ll walk you through everything you need to know about ecommerce business insurance.

- Why Do You Need Ecommerce Business Insurance?

- Types of Business Insurance for Online Stores

- How To Choose Online Business Insurance

- Final Thoughts: The Ultimate Guide to Ecommerce Business Insurance

Why Do You Need Ecommerce Business Insurance?

Ecommerce business isn’t risk-free. It’s high-growth — the expected worldwide ecommerce sales for 2022 are $5.542 trillion — which introduces a range of new risks that retailers in brick-and-mortar probably never had to worry about.

Granted, several risks associated with a traditional retail business (such as the risk of bodily injury to customers or staff) aren’t as big a risk for ecommerce stores. But you also need to worry about other risks that a traditional business probably never dealt with, such as a data breach or a cyber-attack that makes your website inaccessible.

Business insurance for online stores can help you mitigate these risks to protect yourself against unexpected liabilities.

Types of Business Insurance for Online Stores

Different insurance policies offer coverage for different liabilities. For instance, you can get insurance coverage for cyberattacks, loss of business income resulting from business interruption, and more. Below, we talk about the major types of business insurance for online stores.

Business Owner’s Policy

A business owner’s policy (BOP) provides three types of coverage under a single policy. The three types of coverage include:

- General liability insurance: This type of insurance protects you against property damage or liabilities arising from work-related injury to the staff.

- Commercial property insurance: This type of insurance protects you against loss to the business premises (owned or rented) and physical assets in the insured commercial property.

- Business income insurance: When your commercial property is damaged because of fire or a natural disaster, it’ll take a while before it’s restored to a condition where it can be used to store inventory. The interruption will cause you a loss of income, but the insurance company will pay for the lost income if you have business income insurance.

Personal and Advertising Injury Insurance

Your online business may be sued for slander, invasion of privacy, or copyright infringement. For instance, many ecommerce businesses run a blog. If one of the articles makes a false claim about your competitor, they might sue you.

Personal and advertising injury insurance protects you against such claims. The policy generally covers both legal as well as settlement costs.

Product Liability Insurance

Product liability insurance is a business insurance policy that protects you against bodily injury or damage to property caused by a product you make or sell.

For instance, say you sell a hair removal product with a sharp blade. You don’t provide adequate instructions, leading to an injury to one of the buyers. In this case, if the buyer sues you, you’ll incur medical costs, legal fees, and need to pay settlement money. But if you have product liability insurance, the insurance provider will take care of these expenses.

Product liability insurance covers injury or damage caused by the following:

- Defective products

- Design issues

- Lack of adequate instructions and warnings

Some ecommerce business insurance policies add product liability coverage within their general liability policy, while others provide it separately.

Workers’ Compensation Insurance

Workers’ compensation insurance covers medical costs for injury to an employee when working for the business.

For instance, if your employee is moving a heavy box of inventory and slips while moving it, cracking their ankle, you’ll need to pay for their medical expenses unless you have workers’ compensation insurance.

Most U.S. states make workers’ compensation insurance compulsory, so most people don’t have a choice here.

Professional Liability Insurance

When you sell a product through your ecommerce website, you’re entering a contract that probably makes a few promises to the buyer. For instance, you might have mentioned product specifications.

If the product isn’t as per the specifications and causes the buyer to lose money, they could sue you. You might also be sued for other reasons related to the product or its delivery that cause the buyer to lose money.

Cybersecurity Insurance

Data breaches and ransomware attacks are a real threat to ecommerce businesses and their customers. With losses to ecommerce businesses from online payment fraud expected to exceed $20 billion, you need to prepare yourself with top-notch security and cybersecurity insurance.

Cybersecurity insurance covers a range of costs, not just legal fees and settlement expenses. For instance, if your ecommerce website’s security is compromised and a hacker manages to get your customers’ credit card information, cyber liability insurance will provide coverage for:

- Informing the customers about the incident

- Investigating the attack on your website

- Providing credit monitoring services

- Assessing the risk of repeat attacks

- Legal fees

- Settlement

Of course, the exact features of the policy differ among insurance providers.

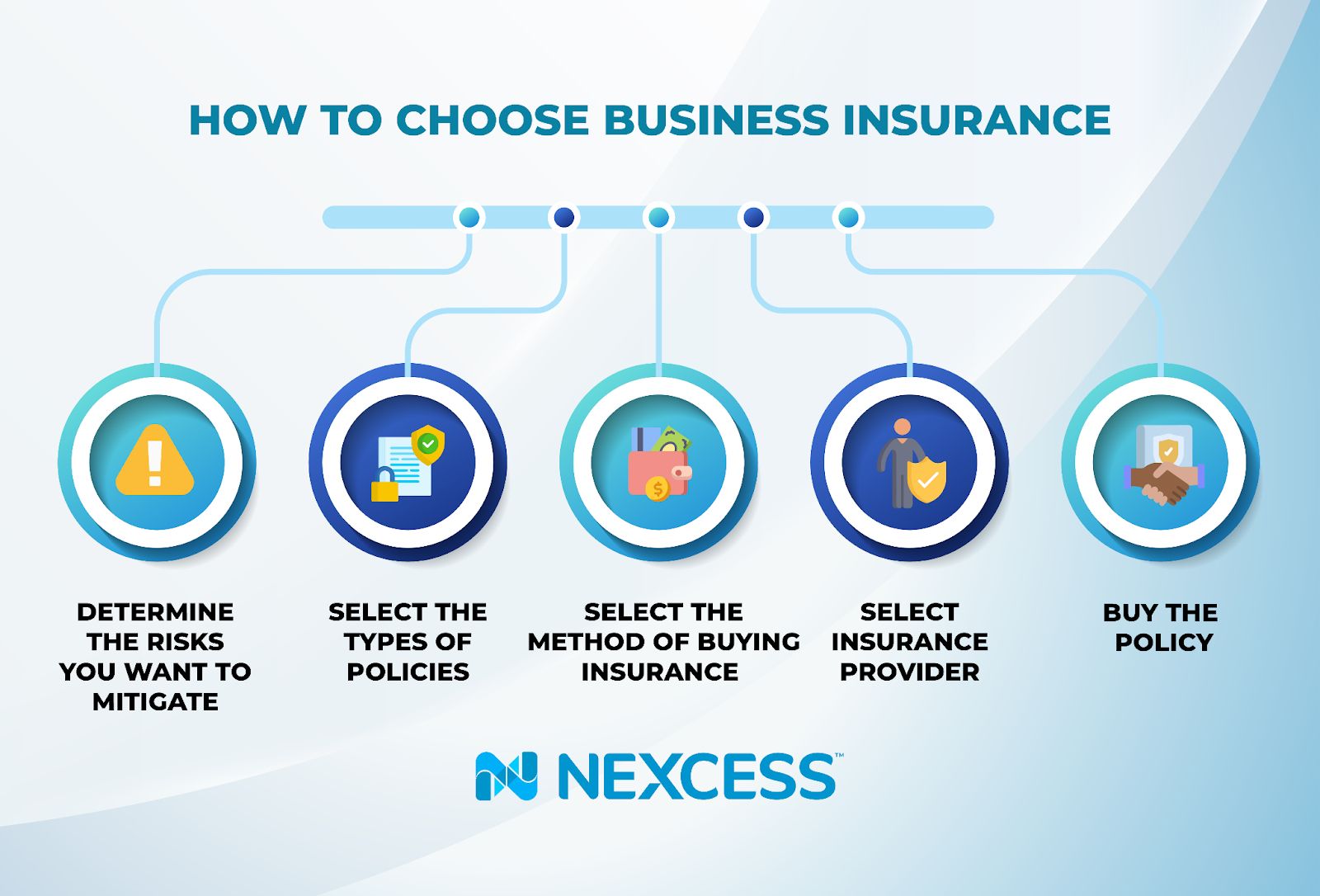

How To Choose Online Business Insurance

It doesn’t make financial sense to buy all types of insurance policies as a small business owner. Since insurance is used for transferring some of the risks to the insurer for a certain amount, you should make sure your business has enough of that risk in the first place and if it will pay off to mitigate that risk.

Below is a process you can use for choosing business insurance for online stores.

1. Determine the Risks You Want to Mitigate

Is your ecommerce business prone to damage from specific kinds of disasters or lawsuits? Do you work from home or have an office? Are you a one-person team, or do you have employees? How do you handle your inventory, and what’s the likelihood of your product harming a customer?

When you answer these questions, you’ll be able to determine the risks you want to mitigate for your business. For instance, if you’re a dropshipping business, you might not need product liability insurance.

2. Select the Types of Policies

Now that you know the risks associated with your ecommerce business, you can select the types of ecommerce business insurance policies.

As an online retailer, general liability insurance, commercial property insurance (assuming you’re using one for business), and product liability insurance may be a good starting point.

If you own a vehicle for making deliveries, you might also consider commercial auto insurance. You can select other types of insurance like cybersecurity insurance and personal or advertising injury insurance based on your needs.

3. Select the Method of Buying Insurance

You can buy insurance online from a marketplace by contacting the insurance company directly or offline through an insurance agency. Most people now use the online marketplace or engage directly with the insurance company since it’s faster.

4. Select Insurance Provider

Once you’ve chosen a mode, find the best insurance provider. Spend time researching online and asking other business owners about the best ecommerce business insurance providers. Request insurance quotes from top providers (most providers offer free quotes), narrow down the list based on reviews from existing customers, and study their policies in more detail.

Here are things you should look for in the agreement:

- Coverage and limits

- Insurance costs

- Quality of customer service

5. Buy the Policy

Once you’ve selected an insurance provider, go ahead and buy the policy using your preferred payment method. Once you’ve made the payment, make sure you get a certificate of insurance if you sell products in an online marketplace like Amazon.

Final Thoughts: The Ultimate Guide to Ecommerce Business Insurance

A business can never be risk-free. However, you can always strategically mitigate business risks. Identifying the types of risks associated with your business helps you find the right insurance policies.

Once you’ve chosen the insurance policies, you should periodically evaluate if you need to add new policies or discontinue an existing policy based on changing business needs.

There are other ways of mitigating business risks too. For instance, as an ecommerce store, downtime can cost you a lot of money.

Choosing reliable ecommerce hosting solutions with excellent uptime history can keep your website available and minimize the risk of losing revenue to downtime. Need a reliable hosting partner? Check out fully managed WooCommerce hosting from Nexcess.