Ecommerce stores that want to cater to a worldwide clientele must provide customers a superior user experience. One of the best ways to do so is to provide a variety of online payment systems.

In this guide, you’ll learn about:

- Benefits of Multiple Ecommerce Payment Systems

- Types of Online Payment Methods

- Online Shopping Payment Methods

Benefits of Multiple Ecommerce Payment Systems

Nowadays, providing multiple ecommerce payment systems isn't just a nice-to-have — it’s a must. In fact, it's an ecommerce website best practice.

According to a 2021 Fiserv study on consumer payments, customers prefer having multiple payment options.

Some advantages of having multiple payment gateways are because they:

- Serve as a backup in case another payment gateway isn't available.

- Open up your customer base internationally, as some payment options aren't available in certain countries. For instance, PayPal does not service Pakistan or Iraq.

- Provide convenience to customers that have a preferred payment method.

- Prevent cart abandonment. According to the Baymard Institute, not having enough payment options was one reason for abandoned shopping carts. You can make more sales just by having multiple payment platforms.

There are several considerations when choosing a payment provider, such as quick checkout and multicurrency support, but platform security is most important. The ecommerce payment system must complement your secure ecommerce website.

Sell your products online, worry-free

Officially recommended by WooCommerce, our hosting is made for online businesses like yours

Types of Online Payment Methods

There are several types of online payment methods, which are categorized according to the following:

- Bank cards: Comprised of credit cards, debit cards, and even prepaid cards, bank cards are used to access financial accounts with the associated bank account.

Top electronic payment processors, such as Visa, Mastercard, and American Express, make it possible for customers to transact with bank cards.

- Digital wallet: A digital wallet is a system that stores a person’s payment information for numerous payment solutions. Digital wallets can be used with mobile payment systems, empowering customers to pay for purchases using their mobile devices, ensuring a seamless checkout process.

Examples include Apple Pay, Amazon Pay, and Google Pay.

- Peer-to-peer (P2P) payments: Peer-to-peer payments (or transactions) are electronic money transfers between two people from their bank accounts or credit cards through an intermediary website or app.

Examples include PayPal, Venmo, and Zelle.

It’s important to note that there is an overlap in some ecommerce payment systems. For instance, PayPal accepts bank cards and can make P2P payments.

Online Shopping Payment Methods

- PayPal.

- Stripe.

- Square.

- Apple Pay.

- Google Pay.

- Amazon Pay.

- Bank transfers.

- Cryptocurrency.

1. PayPal

PayPal is one of the most popular and familiar online payment processors in the world. Online businesses with PayPal checkout options have an 82% higher conversion rate than those without the option.

PayPal lets you accept payments via physical point-of-sale (POS) terminals and QR codes. It also empowers you to accept online payments via PayPal Checkout integrations on your website.

- Advantages: Wide availability (available in over 200 countries).

- Disadvantages: Usage and currency conversion fees on top of regular transaction fees.

- Accepts: Credit cards, debit cards, Venmo, PayPal Credit.

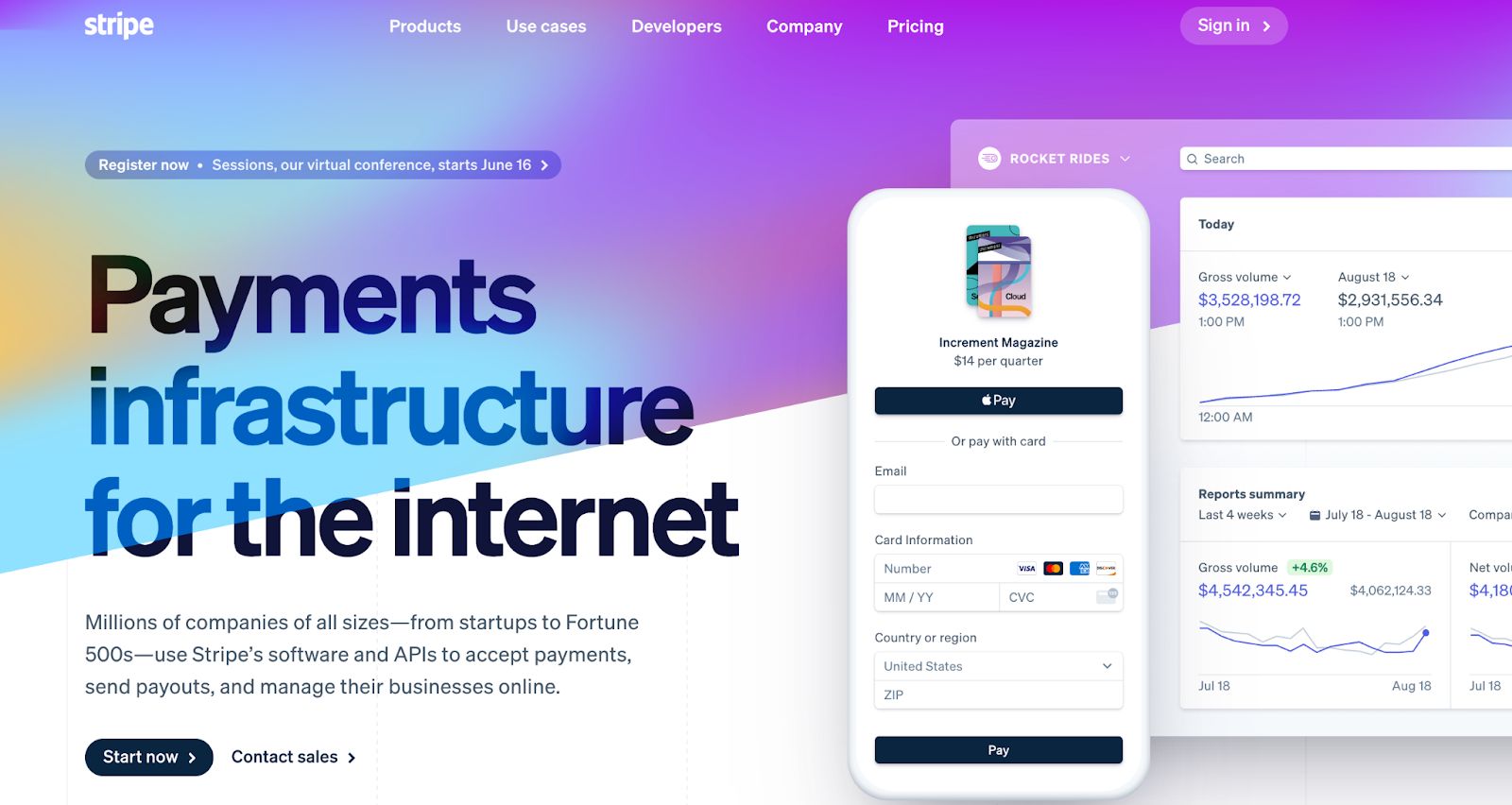

2. Stripe

Stripe is one of the top online payment services for both large and small businesses alike. Besides ecommerce stores, it’s also a recommended ecommerce payment system for subscription sites because of its ability to set up recurring payments.

- Advantages: Can set up recurring payments.

- Disadvantages: Limited availability; setup is not as easy as PayPal’s.

- Accepts: Digital wallet payments (Apple Pay, Google Pay, Grab Pay, Alipay, and Microsoft Pay), credit cards, and debit cards for both online and in-person payments.

3. Square

Although Square is known as an in-person point-of-sale solution that processes credit card transactions, it can also process online transactions. It’s recommended for small businesses that have a physical store and want to set up an ecommerce store.

- Advantages: No monthly fee for using Square as an ecommerce payment system; easy integration with ecommerce sites.

- Disadvantages: Not suitable for large businesses because of stability issues.

- Accepts: Credit cards and debit cards for both online and in-person payments.

4. Apple Pay

Apple Pay is Apple’s ecommerce payment system that empowers users to make secure, contactless payments using their mobile devices. Users add debit and credit card information to their Apple Wallet to make quick payments.

Consumer security is guaranteed courtesy of Face ID and Touch ID, and merchant accounts don't receive sensitive details.

- Advantages: Secure; seamless; easy P2P transfers via iMessage.

- Disadvantages: Apple Pay is only limited to Apple devices and certain countries.

- Accepts: Credit cards, debit cards, and P2P payments via iOS.

5. Google Pay

Formerly known as Google Wallet, Google Pay (or G Pay) is Google’s online payment system used on browsers and apps. Google Pay’s main advantage is that most people have already saved their financial information on their Google accounts, so the checkout process becomes seamless.

Google Pay also allows retailers to set up deals and loyalty programs (without physical cards) and does not charge transaction fees for both merchants and consumers.

- Advantages: Secure; free to use; seamless; wider adoption than Apple Pay (works on both iOS and Android).

- Disadvantages: Limited merchant availability; app issues.

- Accepts: Credit cards, debit cards, bank accounts, and PayPal.

6. Amazon Pay

Amazon Pay is a digital payment processing service similar to PayPal. It empowers customers with Amazon accounts to pay on third-party websites using their stored information, providing a quick checkout experience.

- Advantages: Secure; quick checkout for users with existing Amazon accounts; Amazon fraud protection.

- Disadvantages: Requires Amazon Seller account to use; risk getting shut down if Amazon thinks you violate its terms of service; limited payment options accepted.

- Accepts: Credit cards and debit cards.

7. Bank Transfers

As the name implies, bank transfers involve payment transfer from one bank account to another. It is a common payment method in Europe and Asia.

- Advantages: Safe; can be disputed at the bank; can verify the legitimacy of bank account and its owner.

- Disadvantages: Slow — the merchant will have to verify the customer’s payment before sending out the goods, which can take a while since there are banks without instant transactions.

8. Cryptocurrency

Cryptocurrency and other digital currencies are slowly becoming accepted as legitimate payment methods for online purchases, while some people remain cautious.

Several major retailers, such as Microsoft and PayPal, already accept cryptocurrency as a payment method.

- Advantages: Quick transactions; lower transaction fees; can be treated as an investment (because of the limited quantity).

- Disadvantages: Extremely volatile market; digital currency wallet is unrecoverable; sustainability issues.

Final Thoughts: Top 8 Online Payment Systems for Ecommerce Stores

Having multiple online payment options matters to ecommerce consumers. Each ecommerce payment system should be secure and integrate well with the platform used.

WooCommerce integrates with popular payment gateways and empowers you to build out an ecommerce site easily. Pick a theme, add your content, and start selling.

Managed WooCommerce hosting from Nexcess takes care of your online store, so you can focus on your business.

Check out our managed WooCommerce plans to get started today.